Buy the Dip in These 2 Beaten-Down Stocks, Say Analysts

Everybody likes a discount and the identical is true within the inventory market. However whereas selecting up objects on sale in a retailer is an easy process, selecting up shares on a budget is a extra complicated endeavor.

As a result of an inexpensive inventory usually implies that it has been by the wringer, and the quick query that involves thoughts is, why have the shares taken a beating?

A beaten-down inventory might be down for an entire host of causes, from weak fundamentals to broader macro issues to unreasonable habits by buyers. The trick in fact in shopping for the dip, because the saying goes, is to acknowledge the names which might be solely quickly down and are as a result of push forward as soon as once more.

However easy methods to discover these bargains? Some recommendation from the Wall Road professionals might come in useful right here. Their job in any case is to level out which shares are value leaning into at any given time.

With this as backdrop, we opened the TipRanks database to get the lowdown on two shares which have witnessed an enormous drop not too long ago, however which sure Road analysts are recommending buyers take part within the time-honored act of “shopping for the dip” forward of an anticipated rise. Listed here are the small print.

Roblox Company (RBLX)

We’ll begin with a have a look at a gaming and metaverse firm, Roblox. Roblox has been round for the reason that early 2000s, providing customers an interactive platform to create, play, and share video games – and to work together with one another by them. Roblox payments itself as a metaverse firm, giving its customers greater than the same old on-line expertise can provide. The corporate has mixed group constructing with gaming, to foster creativity and optimistic relationships throughout its consumer base.

Some numbers will give the dimensions of Roblox’s operations. As of the tip of Q2 this 12 months, Roblox might boast some 65.5 million day by day common customers, who collectively spent greater than 14 billion hours engaged with the platform. This large consumer base makes Roblox one of many world’s prime platforms for the under-18 viewers. The corporate is standard with its goal customers, and credit that reputation to its means to develop group amongst customers, players, and builders.

Within the not too long ago reported 2Q23 outcomes, Roblox confirmed a rise on the prime line. Revenues got here in at $680.8 million, for a 15% acquire year-over-year.

Different outcomes weren’t as stable. The underside-line earnings, a net-loss EPS determine of 46 cents per share, in contrast unfavorably to the 30-cent internet loss EPS from 2Q22, however was 2 cents lower than had been anticipated. The corporate delivered $38 million in adjusted internet EBITDA and reported $780.7 million in bookings, a forward-looking metric that got here in properly above the $639.9 million from the year-ago quarter.

Nonetheless, the outcomes weren’t what the analysts have been searching for. Expectations for bookings have been $785 million, and for EBITDA to hit $46 million. The miss right here was decisive, as RBLX shares are down 23% this month, with many of the loss coming after the earnings launch.

For Wedbush analyst Nick McKay, the important thing factors listed here are Roblox’s robust place and consumer base, mixed with a lowered worth that offers buyers a lovely entry level. McKay writes of Roblox, “Q2:23 outcomes introduced mild to some mushy spots inside the firm, however we predict that the info trackers, seasonality, and stubbornness contributed to the misses. On steadiness, nonetheless, Roblox could have probably the most compelling progress trajectory among the many online game names in our protection universe after bearing in mind its consumer base measurement, its new merchandise, and the potential to revisit its method to income.

“With Roblox shares buying and selling properly under our worth goal after a selloff, the chance/reward profile has develop into favorable to the upside… We anticipate affected person buyers to be rewarded by continued topline progress coming from the enlargement of key consumer metrics, a slew of latest product introductions, and a extra aggressive method to value management in future intervals,” McKay went on so as to add.

Wanting ahead for RBLX shares, McKay charges the inventory as Outperform (a Purchase), with a $37 worth goal implying a one-year upside of 24%. (To observe McKay’s observe report, click on right here)

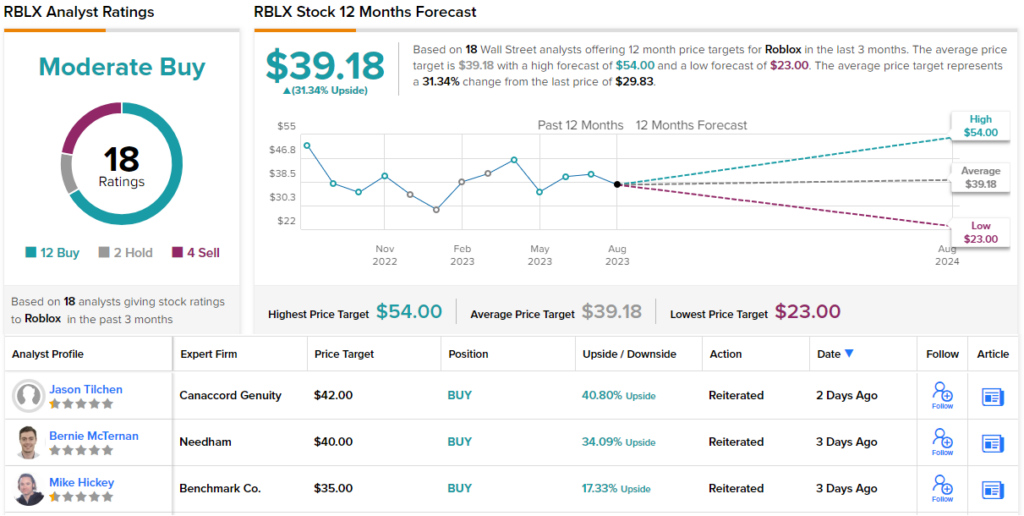

The Road typically has additionally come to a bullish stance on Roblox, with 18 latest analyst evaluations breaking down into 12 Buys, 2 Holds, and 4 Sells, for a Average Purchase consensus ranking. The $29.83 buying and selling worth and $39.05 common worth goal mix to provide an upside of 31% for the 12 months forward. (See Roblox inventory forecast)

Kornit Digital (KRNT)

Subsequent up, Kornit Digital, deliver excessive tech and textiles collectively. The corporate is a world digital printing agency, with a specialty in high-speed, industrial-grade ink jet printing expertise, and it additionally produces pigments and different chemical merchandise. These are utilized in a variety of textile industries, together with clothes, attire, house items, and adorning; Kornit’s printing machines can translate complicated designs from the pc straight onto the material and the completed cloth merchandise, permitting textile employees to name up patterned merchandise on demand.

The flexibility to do that, create patterned completed merchandise as wanted, permits textile artists, makers, and factories, to unlock stock house, remove redundancies, and in any other case streamline operations. Kornit’s clients can use the expertise to help direct-to-garment options for a extra sustainable trend business, that generates much less waste and overproduction, and produces a seamless expertise to make sure that clients will return.

Whereas Kornit holds a number one place in its area of interest, the inventory is down 27% up to now in August. The corporate’s losses have come within the days after its August 9 launch of the 2Q23 monetary numbers. Kornit posted a sixth quarter in a row of net-negative EPS, though the non-GAAP 15-cent per share loss was 6 cents higher than had been anticipated. On the prime line, the corporate’s revenues dissatisfied, coming in at $56.2 million, down 3.3% y/y and greater than $550 million under the forecast. The income miss fed into the share worth drop as did a ahead 2H income information that got here in 7% under Wall Road’s forecast.

When it’s all mentioned and down, Morgan Stanley analyst Erik Woodring believes that Kornit’s share worth loss is buyers’ acquire, because it opens up the inventory for opportunistic shopping for. Woodring takes observe of the headwinds, however states that the corporate has loads of room for progress, writing, “We’re trying previous the near-term challenges to what we consider ought to nonetheless be a 12 months of strong progress in 2024, and proceed to forecast excessive 20% Y/Y income progress in CY24 (+26% Y/Y vs. +28% Y/Y beforehand), albeit off a decrease 2023 beginning base. At a 3.0x goal EV/Gross sales a number of, we’re implying KRNT’s shares nonetheless commerce at a slight low cost to its 2015-2019 valuation when the corporate was compounding income at double digits given the dangers related to the weak near-term spending atmosphere. Mixed, these components [are] driving our improve to Obese.”

That improve to Obese (Purchase) is accompanied by a $29 worth goal, indicating confidence in a acquire of 26% on the 12-month horizon. (To observe Woodring’s observe report, clickhere)

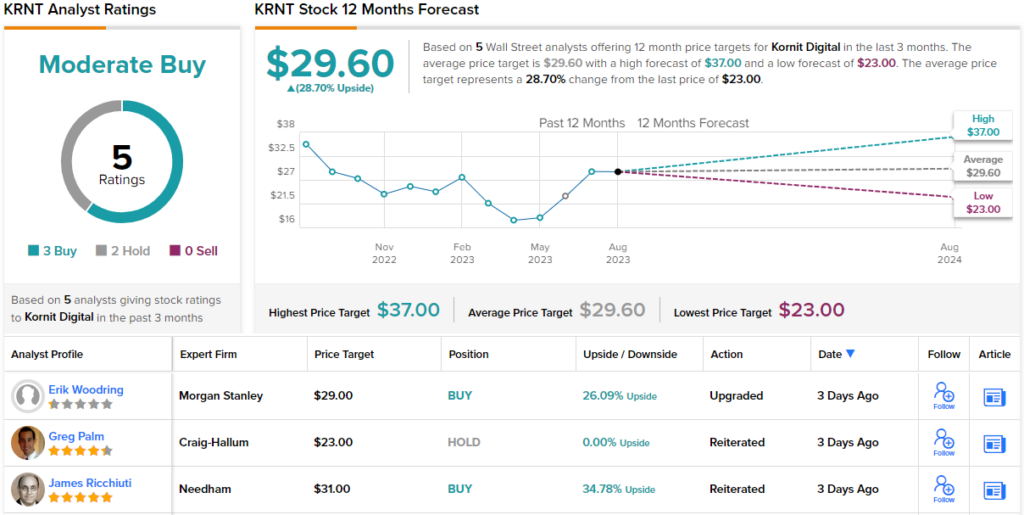

Taking a broader look, we discover that Kornit has 5 latest share evaluations, with a breakdown of three Buys and a couple of Holds supporting a Average Purchase consensus ranking. Shares are buying and selling for $23 and have a median goal worth of $29.60; this implies a 29% enhance from present ranges. (See Kornit inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.